Table of Contents Best WooCommerce Product Filter Plugins Why Use WooCommerce Product Filters? Benefits of…

How to Set Up Tax Rules in WooCommerce: A Step-by-Step Guide

Table of Contents

- Introduction

- Enable Taxes in WooCommerce

- Configure Standard Tax Rates

- Setting Up Reduced and Zero Tax Rates

- Applying Tax Rates Based on Location

- Setting Up Tax Display and Calculation

- Testing and Verifying Tax Settings

- FAQs

Introduction

Setting up tax rules in WooCommerce is essential for compliance and accurate pricing. This guide will walk you through configuring tax settings to suit your business needs.

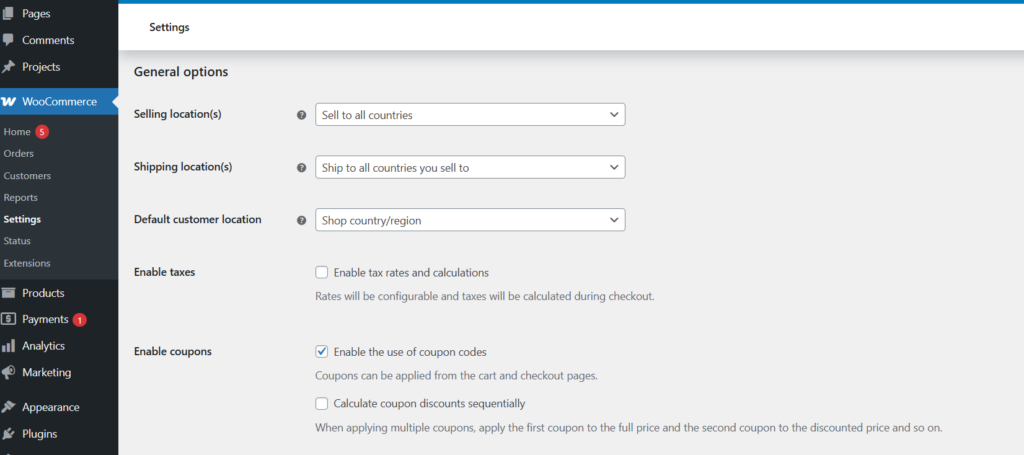

Enable Taxes in WooCommerce

- Go to your WordPress dashboard.

- Navigate to WooCommerce > Settings.

- Click on the General tab.

- Check the box Enable taxes and tax calculations.

- Save changes.

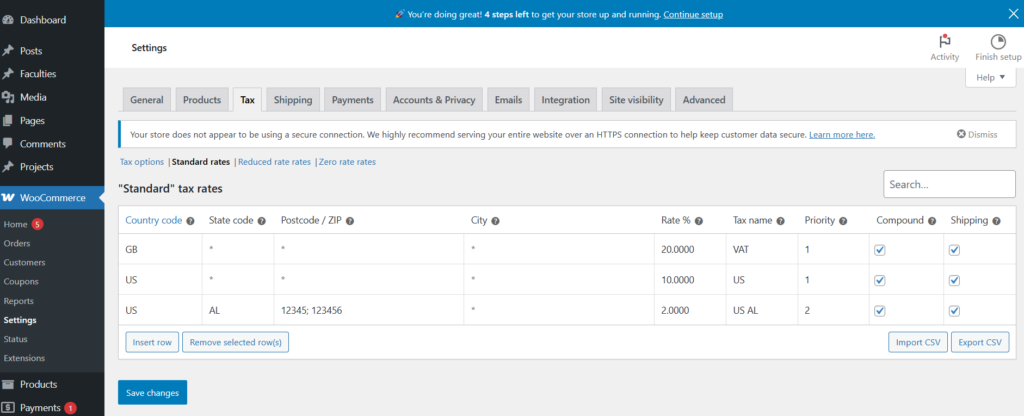

Configure Standard Tax Rates

- Navigate to WooCommerce > Settings > Tax.

- Click on Standard rates.

- Add a new tax rate by clicking Insert row.

- Enter country code, state code, ZIP code, tax rate, and tax name.

- Save changes.

Setting Up Reduced and Zero Tax Rates

- In the Tax tab, click Reduced Rate Rates.

- Add necessary tax rates for reduced tax categories.

- For tax-exempt products, go to Zero Rate Rates and add appropriate settings.

- Save changes.

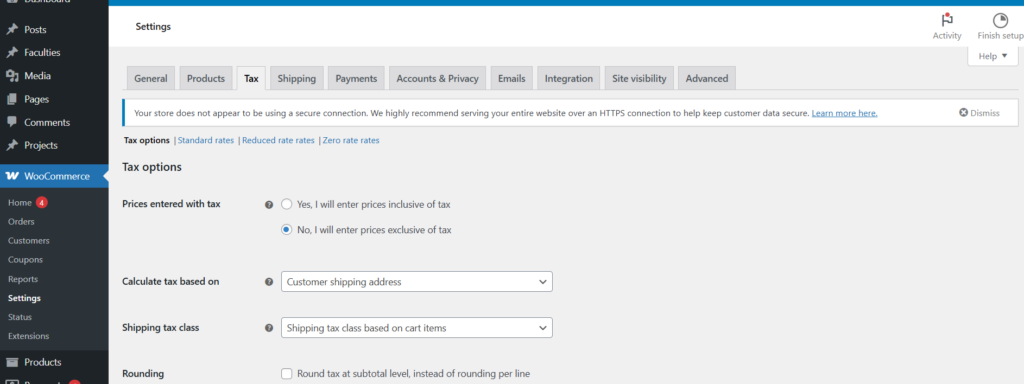

Applying Tax Rates Based on Location

WooCommerce allows tax rates based on:

- Customer’s shipping address

- Customer’s billing address

- Store location Set your preference under WooCommerce > Settings > Tax > Tax options.

Setting Up Tax Display and Calculation

- Display prices inclusive or exclusive of tax under Tax options.

- Choose how tax appears on invoices and checkout pages.

- Enable rounding at subtotal level if necessary.

Testing and Verifying Tax Settings

- Add a product to your cart.

- Proceed to checkout and verify tax calculations.

- Adjust settings if necessary.

FAQs

How do I exempt certain products from tax in WooCommerce?

Go to the product edit page, find the Tax Status option, and select None.

Can WooCommerce calculate taxes automatically?

Yes, you can use WooCommerce Tax Services or plugins like TaxJar and Avalara for automated calculations.

How do I charge different tax rates for different locations?

Use Standard Rates, Reduced Rates, and Zero Rates to apply taxes based on country, state, or ZIP code.

This Post Has 0 Comments